What is the MEES?

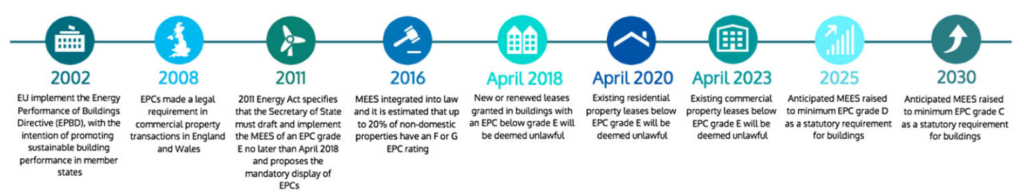

The Minimum Energy Efficiency Standards (MEES) originated from the Energy Act 2011 and were introduced to improve the quality and increase the energy efficiency of privately rented homes and buildings. The MEES sets out the UK’s legal minimum Energy Performance Certificate (EPC) benchmark of domestic and non-domestic buildings.

Given that building operations alone contribute to 28% of global CO2 emissions, the MEES are critical in enabling the UK to meet its net zero carbon target by 2050.

EPC Ratings

The EPC constitutes a legal requirement in property sales and lettings and provides an indication of building energy performance on a scale from ‘A’ as ‘highly efficient’ to ‘G’ as ‘not efficient’. However, there is compelling evidence to suggest that EPCs are unreliable and inaccurate, particularly where they are simply an indication of energy usage and not a measure of real-time in-use performance.

In April 2018 it became unlawful to let a residential or commercial property with an EPC rating below E unless an exemption exists. Since then, this has been extended to all existing residential tenancies and in April 2023, to all commercial tenancies. This will raise further to a D rating by 2025 and C by 2030.

- Exemptions in achieving a legal EPC rating in buildings:

- Where an independent assessor determines that where all relevant energy efficiency improvements have been made, that the costs to do so would not pay for itself through energy savings within seven years.

- If the improvements devalue the property more than 5%.

- Where consent from, for example tenants living in the property or a superior landlord, is refused.

MEES Penalties:

- To rent out a property for less than three months in breach of the MEES is equivalent to 10% of the property’s rateable value, subject to a minimum penalty of £5,000 and a maximum of £50,000.

- After three months, penalty rises to 20% of the rateable value, with a minimum penalty of £10,000 and an eye-watering maximum of £150,000.

- Implications for your development or portfolio not meeting the MEES are:

- In a macro context, where landlords cannot afford to make the intended upgrades, this could see a wave of obsolete and inefficient properties flood the property market.

- Major costs associated with retrofitting and upgrading, particularly if considering a large development or portfolio of assets.

- Potential loss of income for properties which cannot be lawfully let out and disruption to tenants in how quickly these upgrades can be made.

- This will ultimately impact lending and the mortgage market: lenders will no longer grant mortgages on the basis of a property with a sub-standard EPC rating.

- Property de-valuation: given the mass inefficiency of buildings as part of the property stock, could this pull overall house property price averages down?

Opportunities:

- Economies of scale: Flood of inefficient properties entering the market could see a lot of action in property auctions and could constitute an interesting investment opportunity and business case for landlords who can afford to buy and retrofit.

- Landlords can engage with tenants to negotiate green leases, where costs associated with energy efficiency improvements, utility bills and environmental management is a shared responsibility between both parties.

- Property value uplift associated with retrofitting and upgrading the property.

Gas Boiler Ban

The Gas Boiler Ban coming into place in 2025 could work alongside the EPC ratings where landlords need to proactively anticipate this phase-out in their new builds and use alternative solutions.

An alternative is Air Source Heat Pumps, which is set to replace gas boilers by 2025.

If you would like to speak to our team about your developments meeting the Minimum Energy Efficiency Standards, contact Yasmin Booker at yasmin@sayproperty.co.uk.

To read more about sustainability rules and regulations that are shaping the real estate industry, read our other blog here.

Comments are closed.